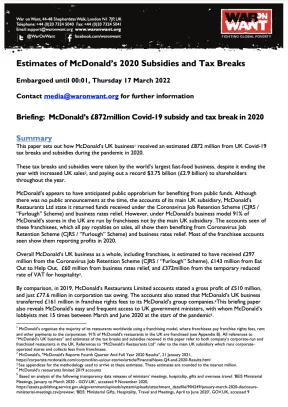

McDonald’s £872million Covid-19 subsidies and tax breaks in 2020

These tax breaks and subsidies were taken by the world’s largest fast-food business, despite it ending the year with increased UK sales, and paying out a record $3.75 billion (£2.9 billion) to shareholders throughout the year.

McDonald’s saw the pandemic as an opportunity to increase its market share. Despite fully closing stores during the first UK lockdown in March 2020, by the final quarter of 2020 McDonald’s had increased UK sales compared with 2019. By the end of 2021, McDonald’s UK sales went on to grow by over 10% compared with 2019.

McDonald’s appears to have anticipated public opprobrium for benefiting from public funds. Although there was no public announcement at the time, the accounts of its main UK subsidiary, McDonald’s Restaurants Ltd state it returned funds received under the Coronavirus Job Retention Scheme (CJRS / “Furlough” Scheme) and business rates relief. However, under McDonald’s business model 91% of McDonald’s stores in the UK are run by franchisees not by the main UK subsidiary. The accounts seen of these franchisees, which all pay royalties on sales, all show them benefiting from Coronavirus Job Retention Scheme (CJRS / “Furlough” Scheme) and business rates relief. Most of the franchisee accounts seen show them reporting profits in 2020.

Overall McDonald’s UK business as a whole, including franchises, is estimated to have received £297 million from the Coronavirus Job Retention Scheme (CJRS / “Furlough” Scheme), £143 million from Eat Out to Help Out, £60 million from business rates relief, and £372million from the temporary reduced rate of VAT for hospitality.

By comparison, in 2019, McDonald’s Restaurants Limited accounts stated a gross profit of £510 million, and just £77.6 million in corporation tax owing. The accounts also stated that McDonald’s UK business transferred £161 million in franchise rights fees to its McDonald’s group companies.

This briefing paper also reveals McDonald’s easy and frequent access to UK government ministers, with whom McDonald’s lobbyists met 15 times between March and June 2020 at the start of the pandemic.