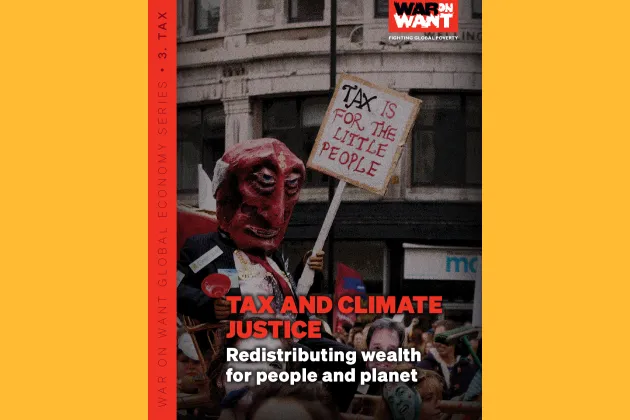

Tax and Climate Justice: Redistributing wealth for people and planet

War on Want has always believed that poverty is political. From our long-standing advocacy for justice not charity, to our campaigns to expose the worst of corporate exploitation and greed, it is clear that poverty is the result of political decisions made by those who hold power: governments and corporations, working within a rigged global economic system.

It’s this system that has enabled wealth, power and influence to consolidate into the hands of a few. Today the ten richest men in the world own more than the bottom 50% – 3.1 billion people.1 People in the wealthiest countries can expect to live on average over 30 years longer than those in the poorest countries.

The richest 10% of people are responsible for nearly 50% of global carbon emissions. Meanwhile, the poorest 50% contribute just 12%. Poverty has devastating implications for the ability of countries and communities to mitigate the effects of climate and ecological breakdown. People in the poorest countries, who have contributed the least to global heating, are already suffering and will continue to suffer the worst of its effects.2

None of this is inevitable. But it has become clear that defeating global poverty and averting climate and ecological breakdown just isn’t possible under the current economic system. We have to change it. And debt, tax and trade rules are vital places to start.

War on Want has worked on tax justice for over 25 years, from leading campaigns for a tax on international financial transactions in the late 1990’s, campaigning against tax havens and tax dodging throughout the 2000s, and exposing the tax abuses of large corporations like Boots and Vodafone and the impact of the UK’s network of tax jurisdictions. Our more recent research has uncovered how McDonalds has avoided paying millions in tax with our campaign efforts contributing to holding the company to account.3

The UK is responsible for 35% of the world’s tax loss, making it by far the world’s greatest enabler of global tax abuse.

The UK is responsible for 35% of the world’s tax loss, making it by far the world’s greatest enabler of global tax abuse.4 Corporations use the UK as a conduit for dodgy tax arrangements that enable them to erode the tax base in the UK and across the world. London is home to the City of London Corporation, and the location of much of the UK’s financial sector, which provides support for tax dodging. The UK is also at the centre of a web of many of the worlds tax havens through its crown dependencies such as Jersey and Guernsey and the Isle of Man, and overseas territories like the Cayman Islands, Bermuda and the British Virgin Islands. The UK government therefore plays a key role in the global tax system.

Inequality begets further inequality. As the top 1% grow richer, they have more incentive and more ability to enrich themselves further.

The current tax system facilitates a highly unequal distribution of wealth, driving deeper levels of inequality both in the UK and globally. Fairer taxation could help redistribute a higher proportion of a society’s wealth towards workers, plug critical gaps in financing for public services, fund a just transition, and provide the resources to help mitigate against the impacts of climate breakdown.

Find out more by downloading the report below.

Share this page

- 1//oxfamilibrary.openrepository.com/bitstream/handle/10546/621341/bp-inequality-kills-170122-en.pdf

- 2//devinit.org/resources/inequality-global-trends/

- 3Stories from the struggle | War on Want

- 4//taxjustice.net/wp-content/uploads/SOTJ/SOTJ23/English/State%20of%20Tax%20Justice%202023%20-%20Tax%20Justice%20Network%20-%20English.pdf